Kathy: Welcome to the august edition of business. As unusual, we are thrilled to have you join us today. We have a fascinating topic. Um, we’re going to discuss how trusted advisors set expectations and keep customers. And so this is really about customer retention and building those strong relationships. I’m Kathy Steele. I’m here today, and Tom Latourette and Chris McKee’ll join me. We’ll tell you a little more about them in a few minutes. But uh, I just wanted to set you up for some housekeeping things. If you have any questions, please add them to the chat. We’ll be answering questions throughout the session. Today, if you’re joining us on any of our social channels our social media channels Dana Welters will be your liaison. She’ll be feeding us any questions from those channels into the chat. And so we won’t be leaving you out of the interaction today. Um, we are, you know, red caffeine is the host, and we are a growth consultancy, and uh, we build up badass brands that people want to work for and with, so this topic is critical to us. Because many customers and our clients are interested in informing new relationships, um, it’s just so important to retain those relationships you’ve earned through sales. So excited to get started a couple of takeaways that you can expect from today’s session is we’ll be talking about how to create an upfront contact track and mutual expectations summary with clients so that you’re both relying on you know what success looks like getting clients to see you as an advisor versus um a you know a line item an expense line item in their income statement and really call you first when they’re challenged training your team to live out that exceptional client experience and then maintaining um and measuring client access success so some insights there so i’m going to kick things off um by introducing my co-host and tom latteray as i mentioned he’s uh the managing partner at m3 learning and every works with companies as large as google and webex to entrepreneurial startups and their solutions change the way sales teams interact with their accounts the relationships will be at the higher levels they’ll be deeper stronger and more collaborative the tools at m3 transform how to your team communicates at every level on the account um and it creates more business effectiveness tom lederae has um really become a disciple of m3 since 2000 when he was the vp of sales and marketing at sbr and he has 26 years of marketing sales and sales management experience tom you look too young no way.

Tom: What when you say it that way, 26 years? That’s a lot of time.

Kathy: I know, I know, like my almost my 40th uh high school reunion that number was terrifying um, but Tom brings a unique perspective because he sat on both sides of the fence in the sales spectrum, and then our guest expert today is Chris McKee and super a dear friend of mine he’s my you know for sure uh ride and diet every time I visit uh dallas so I never miss a chance to have a dinner with chris and he’s he’s just a wealth of information so he founded bench very financial partners in 2000 run after holding accounting leadership roles with several different organizations in the dallas fort worth business community he currently serves as the charity ceo and his mission is to bring sexy back to accounting and i think he’s killing it absolutely justin timberlake watch out because chris his firm grew out of a perceived need a small and medium-sized business need a alternative to traditional in-house accounting department and over the years chris has learned that one of his greatest passions is teaching and feels fortunate to teach crap classes regularly at venturity and out in the greater dallas community chris also enjoys serving on boards with various nonprofits including local and global roles with entrepreneurial organization eo and locally on the boards of the notre dame school of dallas high adventure tracks for dads he’s a really cool dad as well and uh dads and daughters and the dogs syndrome guild of dallas so welcome to you both um i want to always ask that question chris what’s not on the bio tell us a little bit more about you

Chris: Yeah, I think maybe a little context for venturi we’ve got about 50 folks here in Dallas, and we are our focus in terms of clients is typically clients under 20 million in revenue those are clients those types of companies really struggle to attract and retain internal accounting folks and so it’s just much easier for them to outsource we’ve layered on CFO services in the last couple of years as well so we have a real comprehensive solution on the finance side so it’s just a little more context around venturi and I guess around me you know uh at waffle house, I like my hash browns scattered and covered, so that’s my uh, my favorite place.

Tom: What, Chris, the more I hear about you, the more I want to be your friend

Kathy: Please share a little personal nugget about you as well that’s not on your bio

Tom: Uh, I’m a children’s book author

Kathy: Book Author

Tom: My brother and I have run a charitable foundation for the last 20 years that helps local families fight cancer. We’ve given about 1.5 million to over 100 families, and about four years ago, I started, uh, I’ve just recently published my third children’s book, and 100 of the proceeds go to our foundation, so that’s a fantastic little hobby, and I also like my waffle house with the greasy sausage gravy too so

Chris: Good

Kathy: Oh my gosh, I’m going to have to try both waffle house and that food recommendation. Um, coming from two foodie sources, I can say uh, so let’s get get kicking off, I think you know we always try and set the stage um by showcasing some um of the ways people can grow their organizations through these different growth lanes and customer experience really um really spans every type of growth claims like things like metrics like lifetime value customer acquisition costs and increasing wallet share all great reasons to focus on retaining great clown clients, so I think this topic today is going to resonate with so many people because it’s just a part of everything we do as as business leaders and running our company so um I’ll step you quickly through what we’re going to cover off today uh Chris is going you know this is not he’s going to take us through this actual real-world scenario he’s going to talk about why they invested in um building an exceptional customer experience model how they did it um the results that came out of it and some tools techniques and tips, so before we get into Chris I do want to you know give tom just a chance to as a sales coach um sales management expert like what are some of the other fundamental values in um in investing in this type of a program.

Tom: Oh, here’s what I love about Chris and his firm’s work. I think so, especially from a sales standpoint. It’s so easy when you think about being an advisor, a salesperson business development person. It’s so easy when the client brings us in, and we have that first conversation, and they go how can you help me and we a lot of salespeople business development folks advisors who have never been trained and the way to maybe have this conversation we start with trying to tell them how oh well here’s what we do and here’s how we do it and let me tell you blah blah blah let me tell you all about us instead of really understanding we say it’s three words it’s cause decision and outcome what’s causing you to pick up the phone what’s causing the customer the client what’s broken what do they need to be fixed where do they look to go where they want to be in 2024 2025 heck where do they want to be at the end of 2022 um what’s the cause how do they make decisions what is it about their decision-making process that’s really important and why do they make those decisions are there time elements to those decisions and then really what outcome are we looking for what positive effect do we need and what negative outcome are we looking to avoid and what I’m getting to understand from Chris’s organization it’s that space of if you don’t understand the customer experience you can’t answer any of those questions right and you can’t do that in a really powerful way and I think so many organizations this is something that I see you know there the discovery conversation that customer experience understanding is something that a lot of times gets a short shift and we spend so much time talking about what we do and how we do it and we don’t align that to what the customer needs and what their experience needs to be throughout the process so it’s really important.

Kathy: Absolutely

Tom: And so I’d love to I mean I guess Kathy unless you have a because I’d love to ask you know Chris what I mean you know with customers experience being so important what had you start to you know this mission to improve customer experience what was it about that

Chris: Yeah you know it’s funny because we really didn’t start this journey until we were probably so we’ve been around for a little over 20 years it was really over 15 years into our journey as a company uh and so my background is as Kathy said a very traditional accounting background and we started it to kind of fulfill real need with smaller businesses to um uh to really uh help them with their accounting something that they were really struggling with and as an accountant, I really thought you know that’s enough I mean you know on the face of it we’re going to do a great job with their accounting and so you know this slide shows some of our values the other two that aren’t on here are great accounting and exceptional service and those are really our first two values and great accounting everything really starts with great accounting and for us we really felt that delivering great accounting was synonymous with an excellent customer experience and what we really realized that that not everybody really appreciates the value of great accounting and it’s really about more than just um getting the debits and credits right it’s really about building a relationship with our with our clients so um so really what started us on this journey was we were delivering great accounting over and over again month after month and we thought we had a great relationship with our clients but we were getting these random you know uh letters from our emails from our clients saying hey you know what we’ve we found another solution so we call them dear john letters after a while we were completely uh caught off guard by a lot of these uh um notices and we uh and after a while you know it started where we thought to ourselves well it’s really more their problem than our problem they don’t really understand how great of a job we’re doing and we just need to really double down on explaining to them how great of a job that we’re doing but um you know there were points at which and Kathy I think you were instrumental in helping us sort of launch this journey as well uh because as we kind of got to know you guys we were talking to you we were actually had a really robust sales process we had no problem with sales but we had clients going out the back door as quickly as uh we had him coming in the front door and it wasn’t necessarily it wasn’t really because we were doing a bad job with the accounting it was something else we couldn’t really figure out what it was so that was really why we uh sort of uh entered on this journey because like we’ve got to figure this out because we can’t we’re not we’re never going to grow if we’re uh losing clients more quickly than we uh then we’re able to sell them and we’re able to bring them in the front door and we just we didn’t know what it was so we had to we realized we had to kind of figure it out

Tom: Well, that’s so interesting, right like you because I think most of us we believe well if we just do our job better if we just work harder then great they’ll know oh look how fantastic they are and so once you realize this uh how did you establish goals how did you select the internal team to work on this initiative well how did you do that

Chris: Yeah i mean the first thing we had to figure out is um you know how were we going to tackle it is this something that uh the management team we had like a three person management team uh how are we going to tackle it or is this something that’s team’s responsibility or what and so you know that was a little bit of soul-searching at first but what we decided to do was put together we said look we really this is not something that we’re going to solve at the top of the organization and just tell people what to do and that’s going to suddenly going to get better I think we really got to talk with our team members that are working with our clients every day to get a good feel for what they think is going on so we decided to put together a what we call a client experience work group so to go a little deep on maturity we have committees within our organization that are kind of our fund committee in our cares committee that do things to enhance our culture and then we have work groups that we put together that are across sections of our organization that tackle specific issues so we’ve had several of them over the years and they’re there to sort of come together and then sort of disbanding when the when the problem is solved if you will so we decided hey we need to put together a work group and really understand this a little bit better and uh it was apparent from the beginning that it was not going to be a short journey so we went to uh so we actually pulled in kind of a cross-section of folks and we offered it to several team members as well and said hey do you want to be part of this initiative so we put together a team of aides that that really were a cross-section of the um the organization and I sat on the work group and really facilitated it but I tried to really have my presence be just one of facilitation versus one of kind of coming up with all the ideas and the explanations and but i felt i needed to be there just from a standpoint of showing the group that this is something that we take seriously right at the very top of the organization so and we really the goals of it were to because we didn’t know what was causing it we had ideas anecdotal stories but we said look we’ve really got to get some data and understand this so the first piece was really understand it and then come up with some things we could change that would help stem the tide if you will um and early on we established in some of our first couple of meetings that the two things we really wanted to accomplish was not just reduce attrition and uh but also really if we were going to reduce attrition we also needed to substantially improve our clients experience with maturity i mean we our clients deserve that we have we handle a trusted piece of their business and their accounting it’s something that’s super important and the financial information helps them make better business decisions if it’s done well and so we really needed to not just provide great accounting information but really we there was so much opportunity to improve our client experience we said hey when we come out the other end of this process not only do we need to have reduced client attrition that’s the metric we’re maybe going to use to measure our success and that’s one of our goals that we need but we need to really transform that client experience and that’s how we’re going to keep clients long term rather than try and run around and fix little problems we need to really start with a better client experience and that’s that’s what’s really going to help us not your typical uh accounting experience is really kind of what we what we talked about and so early on we defined also we can we’ll talk a little more about this but controllable versus uncontrollable nutrition so one of our goals was to focus on controllable attrition um which is you know people just quit us and replaced us versus a company going out of business which would be kind of uncontrollable and our goal was really to get long-term goal or sort of b hag as they say was to get controllable attrition down to zero for a 12 month period so we figured if we may never get there but if we set that as the goal it’s really sort of saying okay well wait a minute we got to really do something different if we’re if we’re going for that big of a goal we’ve got to do something different so it really challenged us in that way so that’s that’s what our client experience group looked like and that’s kind of where our goals were

Tom: What a great start, what a great start, yeah

Kathy: Yeah, and I think that you know, knowing your culture and your company pretty intimately and knowing a lot of your employees, you have that intentional employee experience, so it’s so interesting that you then turn the table on that investment in your course that you know to what you’re doing with customers take us through you know some of the things that you did to get there um take us through you know what the steps you went through

Chris: Yeah, I think the first thing we needed to really do was just as I talked about earlier, we didn’t know what was causing it, so we needed to understand what the issue was, and so we went through a previous three years of attrition like all the clients that had left us over the previous three years and had really sort of frank open and honest conversations about why they left, and that’s how we sort of started to parse things out into controllable and uncontrollable attrition and so uncontrollable attrition was the company went out of business, or they sold to somebody else, and we just had no chance of maintaining the business like we weren’t given an opportunity to propose they said you know thank you very much we’ve got our own county department see you later by so um but then everything else really falls into controllable attrition and so then we just we focused on that piece, and we said okay what um you know what went wrong or with each of these relationships so the graphic on the screen is like an actual snapshot of client attrition for 2015 and its client by client and what we it has their fees and their tenure with us and then sort of detail in the comments in detail why they left so, and it was really just some fascinating conversations, uh and it’s it wasn’t us it wasn’t a fast process to go through those three years of attritions we’re meeting that three years of attrition we’re meeting every two weeks and it took us actually several months to get through all of this because I wasn’t going to let it go uh oh they you know they left because of x well then uh and maybe I knew something a little different so we dig a little deeper, and part of it was just getting uh getting an um, I don’t know some agreement on how we were going to have the conversation and really get to be honest about why they left.

Tom: Chris, like it this. I mean, it’s fantastic. I love this. Where did you pull the data from? What were you guys keeping track of this in a CRM, or uh, where were you pulling all this down

Chris: I would love to say that we were, but we weren’t. I mean, it was uh, we had to go. That’s why it took so long as we some of the people in the room had experience with these clients um Deanna walker who’s our chief revenue officer and the head of the business development side is very involved in these client transitions, so she knew a lot of the data as well, but we also charge people with going out and saying okay this person worked on it I want to really get down to the nitty-gritty of why this client left so.

Tom: So you could be even having conversations about uh issues and conversations that happened a year or two ago, right like that’s

Chris: Absolutely, and we just tried to encourage people to be honest about it, and you know, and sometimes it was multiple factors, but I think what emerged over time was uh, there were sort of four or five main reasons that a client left us and so um uh and so that was that was super important, uh to understand and so once we were kind of left once we got that understanding uh, we were we turned kind of the conversation to you can go ahead and advance the slide I think we turned the conversation to all right what are we gonna what are now that we know what those issues are how are we going to change our processes so I’ll give you a couple of examples of some of the issues you know some of the issues were perhaps that we um we had a misalignment of expectations like we thought that what we were doing was great, but the client thought we would do something completely different, okay or we thought that we would interact with them in a certain way, and they thought we would interact with them in a different way, so there were there were a lot of problems around misaligned expectations um there were also just a lot of problems with we just kept doing our thing, and we weren’t um really spending enough time with the client having deeper conversations with them and so we sort of lost touch with the relationship so that was another sort of bucket um sometimes there were things that we couldn’t do that they needed us to do and so that became an issue that one of them being sort of higher level advice which is sort of CFO level work and so what grew out of that was actually a new practice for us too so what we needed to do is we went through those buckets and said okay what do we need to do differently at various stages of the relationship in order to keep those things from happening so um so that whole bucket of expectations that we talked about where we just seem to be doing this with the client uh we actually spent the first couple of months after the understanding process we got in the designing process but okay how can we solve that problem all right well first let’s get on the board everything that we’ve had a problem with in terms of expectations uh with our clients like and not only what

Tom: You’re whiteboarding this mutual expectation

Chris: Absolutely that’s that’s exactly what we did, and that’s what this document really uh came that came out of this process, and they were, you know, they were really honest about ourselves they weren’t just things that problems with the client’s expectations but often expectations of ourselves as well so so we actually there’s two columns here and on the left column are the things that uh we commit to and then on the right column of things the client commits to you, and we go over this um we allude to it during the sales process we go over in our initial implementation meeting and say look these are the expectations that we have for the relationship and there are things in here like being an active, engaged partner we ask that of them but um but we also on our side uh take a personal interest in their business and their success so that’s a commitment we make to them we we ask them to be actively engaged in a relationship you know on our side we commit to being friendly professional available and accessible that’s sort of how we’re going to be present with them we ask them to foster a positive working relationship that is marked by mutual respect and that was something that clients didn’t know sometimes that we that was an expectation so the great thing is is we get there we get everyone’s buying and we’re like we’re ready to commit to these things if you guys are ready to commit to your side of it and for um our clients you’re like thank you so much for sort of laying that we got we had such a positive reaction with us it was it was um it was amazing the positive feedback we got but the great thing is we can tie back to this when we have issues later in the relationship it’s like well you know you committed to get us information in a timely manner and then we’ll get you the financials in a timely manner but you’re not holding up that end of the bargain, so let’s talk a little bit about that

Tom: So Chris, it sounds like when you were designing this, you actually went to some of your maybe more successful customer relationships and interviewed them in terms of the expectations piece or

Chris: You know, that’s interesting. We didn’t actually do that. It came out of that like what are the uh when we sort of brainstormed it because we had gotten a lot of feedback from the customers who left like you to know that that we sort of took a lot of that and sort of got it on the board a lot of people in the room had had personal experiences with this so um, but once we developed this we started trialing it with new clients when we sat down with them and then we also put a regroup process in place with our current clients, and we started getting a lot of great feedback on so it was really.

Tom: So then you know it’s working. You know that you’ve we’re asking the right questions.

Chris: Yeah yeah yeah, and we didn’t tweet it, you know, we did continue to tweak it, and this is kind of important right now, and it looks, you know, here’s a big argument that we had it looks super detailed um, and we went back and forth well does this need to be like just a few keywords and three or four things, and this is really going to overwhelm them, and they’re not going to engage with this, and we decided to just double down on being really specific about our expectations in the relationship, and we go that route um, and just we found that being sometimes you’ve just got to have you got to embrace the detail it was such an important piece of setting up the relationship uh that we decided we were going to double down on really going into a lot of detail on it and it was well received it was that we it allowed us to be much more clear about our expectations and what we were committing to on our side as well

Kathy: So Chris, was it a sort of an iterative process you mentioned that you had? You know you learned some things once you started to get it in the market. Did you, um, have anything drastically changed from its first version to where you are now?

Chris: Uh, you know, this particular document has definitely been tweaked a little bit um, this was the first thing we went out with, so you know we had several months of understanding, and then we spent the next uh two or three months really putting this piece together, and we had other things we needed to do and that we were going to do but we went ahead and started getting this out there with the clients and trained our folks in it so, so that was really cool, the next piece we put in place, uh, you want to advance the slide was a whole series of regroups that we do with our clients. This is heavy detail. This is kind of the behind the scenes accountability for us it’s a process we put in place around periodic regroups that we do with clients at key points in the relationship, and Kathy, I’ve got to kind of credit you with from some of the conversations that we had about, uh, some of the quarterly and annual regrips that you have with your clients it was a real seed to that bucket of things where we just lost touch with the client, so we had our misalignment of expectations, and we’re addressing with the expectations document and then the next bucket was okay we just lost touch with the client how can we prevent that and so we have at key points in the relationship and then at no less than an annual basis we have a regroup meeting and that regroup meeting based on this design is super structured and this is the behind the scenes piece where we prep and we’ve given guidance to the team based on what type of regroup meeting is it is it at a transition from implementations to the team is it three months after that transition is an annual regroup so we documented for the team exactly what we need to be addressing at each one of these meetings in order to tease out some of the um issues that might come up during during the relationship so those client regroups are are really huge and we get the key members of their of the relationship on their side and our service team together for those regroups and we said we’re not going to talk about financials today we’re going to talk about our relationship and so that’s that’s that is sort of the next piece that we put together that really helped us so and this definitely was an iterative process so

Kathy: I love this piece. I do think you know we actually were just talking about this week internally about you know how different it is posted that you know first 90 days so you’ve got sort of the honeymoon phase and it’s more like the getting to know you phase and then but that’s so much different versus somebody renewing for the second or third or fourth year absolutely and it and so I think it’s really important to highlight there are phases of relationships just like marriages I guess yeah.

Tom: That’s fantastic, and to make a good marriage work, you better be in constant communication, right to make this work. It’s really strong.

Kathy: I think that structure is so critical too because these are the things that fall by the wayside, and you know, not every client warrants a quarterly business review or a quarterly um touch point, but you know, at least a couple of times a year getting you to know getting together throughout the relationship just at a high level to talk beyond you know what you’re actually doing for them is is so cool

Chris: Yeah, and we had to get out of our head a little bit too of we felt like it was a big ask for the client to spend our time spend their time talking about our relationship, uh you know one of our on our value of exceptional services it talks about a humble attitude of service to others that’s really key to how we service our clients and so it was we had to kind of get out of our head on this idea we’re going to ask the clients to sit down with us for an hour hour and a half and really talk about the relationship and go through the good and bad the ugly so um, but we have once we started the process and once a few people once a few of our team members started doing it we got a lot of great feedback from the team members like oh my god it was so nice to be like now I know like before I didn’t really know how I know and I had a chance to really build my relationships

Tom: Chris, have you found, um, that sometimes in these conversations, all of a sudden you learn how the client is pivoting their business where they’re looking to grow that maybe the way they were doing it for the last six months has shifted a little bit and you wouldn’t have known that unless you had this conversation have you had any of those situations occur where now you’re able to help the client at a much better level broader level

Chris: Yeah yeah, no, no question about it. I think that another key piece that we figured out was not only did we lose sometimes lose touch with our clients but the type of relationship that we had with our client Kathy you alluded to earlier sort of moving from that vendor relationship to that partner relationship to that trusted advisor relationship and that if we were going to maintain clients, particularly with the trusted function that we have with them we really needed to build toward a trusted advisor relationship, and so that was sort of the next piece we designed was a training program on how to be a trusted advisor, and so that was that was really the next piece that we really did with folks after we developed these tools, we had a company-wide training uh with everyone, and we taught them about one of the training classes was understanding attrition, so we took them through the same journey in an hour that we went through over the course of three months and helped them understand why we had attrition so this is the hey this is why this is important okay and then we talk to them next about understanding how to how we’re going to set expectations with clients going forward okay, and then we did this training class on the trusted advisor approach, and this was really kind of the marquee class in the middle of the training process, and all of these were company-wide training we were all together and we had a series of experiential pieces work things throughout the day where they worked on things together around specific client situations as well but in this trusted advisor approach like this is not intuitive to your average accountant like we were trained I was trained to just do debits and credits and the world should appreciate that and that’s wonderful to really think that way but I know everyone here who’s not an accountant it sounds puzzling to them that we would think that so you know we really um uh it’s great accounting is not necessarily the foundation of a great relationship you’ve got to do you’ve got to make a conscious effort to really uh build your relationship and so we went through this training and it talked about how to build rapport and how to ask questions to understand the client’s business so time to your point of you know learning things about the business that we didn’t know before you know and uh identifying opportunities where we could serve them more broadly I mean we had clients before that used to say well i didn’t know you guys could do that I wouldn’t have hired somebody to do that we just weren’t in the habit of talking about that thing so the other piece is continually growing your expertise as a team member and bringing that value to the to the client and the last just constantly building trust by doing what we say we’re going to do delivering great financial information and just being there for them just builds that trust so those were some things we talked about this trusted advisor approach to trey we defined what a trusted advisor relationship uh looked like and then we trained around it and that was key so absolutely

Tom: And then we’ll go ahead, Kev, yeah

Kathy: All right, you did just a couple of follow-ons on the train. You did all the training internally correctly, mostly with your internal team.

Chris: Designed it all ourselves, customized it all ourselves because our client relationships we wanted to be really tailored to our client relationships

Kathy: And then it’s part of your ongoing onboarding as you add new team members

Chris: We recorded all of the training and uh and then you know condense the videos down to uh uh really the working sessions and things like that out and so now in the first two weeks um they get this uh client experience training, and so they understand the like we’re all talking the same language around client experience they really understand what that means and when they’re working with their clients and the more senior people on the engagement really are talking about client experience and creating client experience they know what that context is it’s really just from the earliest weeks that they’re with the company they get this training so

Tom: So everyone in the organization is going through this at some point they’re going they’ve gone through it um how are how’s the team administering it how are you monitoring it how are you making sure that everyone’s known

Chris: Yeah, I think that was the piece that, uh, I was probably going to be. I was going to blow right by if the rest of the workgroup uh didn’t hold me accountable because I thought, oh, we figured it out. We’re going to train everybody. It’ll all be great. I think whoa, we got to monitor it on the back end to the kind of make sure that that we know whether it’s working or not so that whole we that regroup process we have a regroup tracker and we track for every relationship whether we’re doing our regroups and when they’re due and so because that’s such a key piece of that of that relationship are those periodic regroups so that we’re checking in on how we’re doing and uh what’s going on with the business we do have we are fortunate enough that we meet with our clients every month to go through their financials so we’re super lucky in that we we’re in communication with them almost every day but we sit down once a month to go through their financials and that’s a great opportunity for us to sort of build that trust from a trusted advisor standpoint so we should be checking in with them each month on their relationship in addition to those regroups but we have that regroup tracker and we have we actually established a role called the director of client experience and she was just someone who was on this client experience work group who just has a natural affinity for client experience and she’s been a controller with us for a number of years but was ready to really move move up in the organization in that way and just has a passion for this and an intuition for it as well so you know when you establish a role in the organization that theirs their sole purpose is to is to support the teams in creating great experience for our client and also really as a demonstration to the organization how important that we think it is and so she’s responsible uh ultimately for making sure we’re staying true to this not just in things like client regroups and setting expectations but also just in the daily interactions with our clients reads you know even reads a lot of the emails that go email traffic and jumps in and says hey here’s a more uh client experience way to share that information with the client this is a way to build trust and rapport with the client those like kind of just

Tom: Embedded in your culture, right? It’s become just part of who you folks are, right?

Kathy: I mean, it’s always

Chris: Come a long way. I’ll tell you.

Kathy: When you have a process, I think it also you know you’re constantly tweaking, but you know if it’s it’s I think it’s a build you know you get that baseline of infrastructure and then then you something is not working and then you can tweak it’s not trying to eat the whole apple all over again, so I love that you just add being additive to the process

Chris: Yeah yeah yeah and so you know one thing i mentioned earlier about kind of identifying the cfo practice so we were uh somebody had a question around this that i share like we so one of the buckets was we would we would lose business because they would bring in another advisor uh that would earn their trust and then would get us elbowed out of the situation oh you don’t need that maturity anymore i got you covered so there were a lot of clients that needed the expertise of a chief financial officer and our role is doing the accounting so we were kind of the controller on down to use some accounting terminology um you know we paid the bills did the financials really made sure their accounting was ticking but what they needed was more in addition to that it was more strategic advice and so they would engage a fractional cfo perhaps and um and then oftentimes we’d lose the relationship because that person would become their trusted advisor and we became more of a vendor and then that advisor would get us replaced and so so we said look this is something we can do and what we i was probably the one that was most resistant to it because i’m in love with accounting but i didn’t realize how much our clients really needed this, and so we’ve been in this business for a couple of years now we’ve got uh three fractional cfos serving our clients and uh man almost weekly we have clients like oh my god I’m so glad you guys added this is what we really this is really rounded out our relationship this is so that was kind of how we took something that came out of that and said no it started as a defensive like we’ve got to do this, or somebody else is going to do it to where it’s like wait a minute this is how we’re going to enhance our trusted advisor relationship with the client this is we should have been doing this all along but Chris that well he didn’t really know so you know and so so that’s really how that learning translated into a new amount of business for us, and it’s not just to earn us additional revenue. It’s because it’s our clients need us to do that for them, and it’s a complete client relationship

Tom: You know what I hear you just said. Is it that place of understanding the customer’s expectation the customer’s experience takes you from a transactional just someone who’s providing a service into a strategic partner right that space and it’s it’s putting us offensive then defensive I love that really good

Chris: Yeah

Kathy: It’s a lot more sticky to be in that advisory place versus being transactional so Chris, I know you had some other, you know, really good outcomes. Can you share some other things that came out of work?

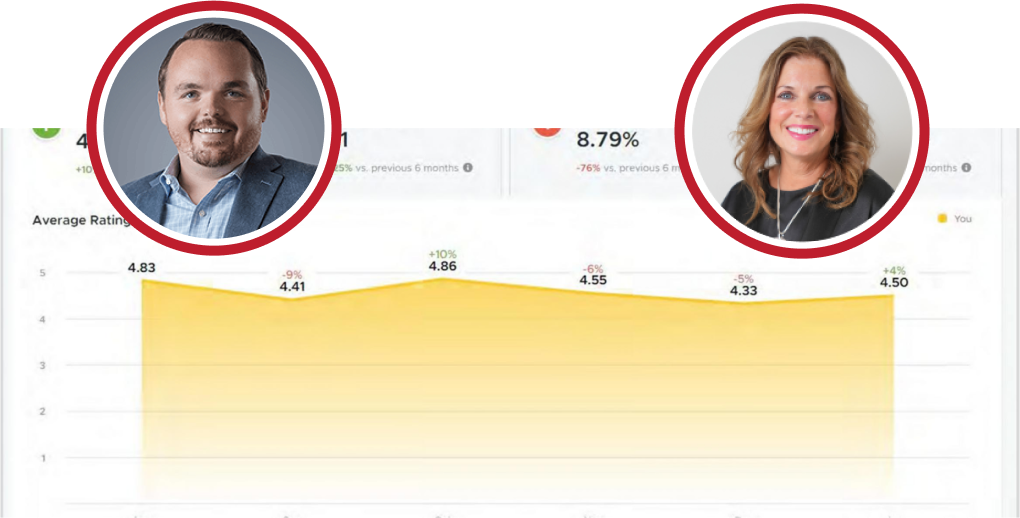

Chris: Yeah I think one of the other tools that we put in place was we started surveying our clients regularly and so we on a rotating basis we survey all our clients quarterly and we survey not just the CEO but some of the uh the team members that we work with every day anybody that we work with the client we’re surveying them once a quarter and that’s this net promoter score so not only do we have the regroup tracker and our director of client experience but then we put net promoter score surveys in place and so you guys that are familiar with it or maybe unfamiliar with it it’s just a one question survey that’s would you recommend venturity to a colleague or friend and so um we didn’t know kind of we’d never done that survey before so we didn’t know where it would come out um you know what we were what we thought we would find is we would have a really low net promoter score survey and then as we started rolling this program out and building rapport uh that our survey would go up and so we’d see like a movement well our survey is out of the gate and this is not so a typical nps score in the accounting world I did some research on this is like around 38 or 40 is your nps score out of the gate we came out at a 90 and we’ve never been below a 90 we’ve been like 90 90. that’s ridiculous so it was nice to know that for our clients that we have that uh have a good relationship I mean we have they’re promoters I mean they’re big promoters of our of what we do and we have a really strong and solid relationship but what it has done is occasionally we will get a survey that’s like you gotta suck you know it’s a detractor it’s a five or something like that or a three and it gave us sort of an early warning system because in the past the clients would have just been angry and we never would have known you know so um and you know maybe we go three or four months before we have a client regroup with them and but they’re mad that day and they get that survey and we you know we get that feedback and then we’re able to jump in so it gave us another tool even though we didn’t we didn’t it was different than what we originally thought we’d get out of that tool we’re getting what we are getting is sort of the early warning system when we do have a problem so so that’s the last piece of the monitoring deal but someone so that’s one of the outcomes that really came that came out there’s several outcomes one you know we just really it gave our people the confidence to have different types of conversations than they were having before with our clients and it took time and they’re accountants and they’re shy and they’re introverted but as um you know we i will say that our client our our team members are not your typical accountants that you would think from that standpoint they tend to be a little more outgoing than typical account so they they embraced it more than your typical accountant by it but it still was it still was out of their comfort zone so it took time but man they they would get such positive feedback as they relationship as their relationship with the client really drew a lot closer that um that it sort of built on itself in that way so that was that was really a big outcome from it and as they learned more about each client’s business they got better at the accounting on that client because if they understood the business better they are going to do a better job on the accounting so that was that was kind of a key outcome as well and so i will tell you the the million-dollar question is literally a million-dollar question for us because we were having you know a million dollars plus a year of client turnover and fees it did substantially reduce controllable attrition so we are our typical attrition for a year was 25 to thirty clients that we would lose which was crazy because we’ve got 100 and 230 clients so we had a huge amount of attrition during the course of the year and two-thirds of that was controllable attrition so two years into this program after we rolled it out we reduced that to a total of 18 clients but only 12 12 of that was controllable and that was two years in and a lot of that controllable attrition was where we actually decided to part ways with the client so uh we actually consider that to be controllable attrition because it’s not i mean it’s it’s it was maybe the wrong relationship that we got into in the first place or um you know we let the relationship go and we couldn’t really get it back so someone so there but we had almost no surprise emails on a monday morning um on the first of the month that said hey we we’re giving you a 30 years notice so see you later bye uh you’ve already hired somebody new and all of that it’s it’s uh so we have hardly any of those anymore and that’s really it’s it’s really a substantial decrease I mean so attrition has gone from probably in terms of revenue 20 of our client base each year now down to about 10 of our client base every year and that’s your it’s it’s an outsourcing business so it’s never going to be perfect but we still have that goal out there in fact it’s in our vision for our business that we are going to have a 12-month period we’re going to lose no clients to control of attrition so we’re continually revisiting this through our director of client experience which is continuing to hold us accountable to it so um so you know there’s the tangible reducing attrition but there’s also the intangible of really building significantly closer relationships and we you know one of our goals was to get the call like when our client needs something rather than calling somebody else we’re their first call and that has been night and day I mean in our in the majority of our client relationships we get the call first and if we can’t do it we’ll help them find somebody but it’s

Tom: Chris, we probably haven’t had a better example of that than in the last two years with you know with Covid and with everything how did the pandemic impact, uh you know this work that you guys are doing did you find that because you had already done this that your relationships with your clients were significantly better how did you know how the pandemic show up for you Guys

Chris: It’s an interesting question. I mean, you know, we had some clients that just were devastated by the pandemic and shut down, but we really kept all of our other relationships and I think that through this whole idea of being trusted advisors for our clients and some other things we’ve done in terms of open-book management our team sort of immediately sort of jumped in and said okay how can we a protect our revenue in other words like you know as a business we need to keep our jobs so what can we do for our clients during this difficult time and you know within a few days after some of these things in the paper about the news about ppp and what is that you know our clients and our and our weekly idols excuse me our team members and our weekly hunters huddles we’re saying hey we’re hearing about this ppp thing is there’s something we can help our clients but well gosh and by april um when uh when that stuff kind of came into place first for really substantially all of our clients we were doing their ppp applications and pulling together we were the best people positioned to do it and we got the call from him to do it like we were proactive about going to them but they trusted us to do it at the same time as well and I think that’s where a lot of that foundational work really helped um you know in terms of the pandemic we didn’t have as many face-to-face meetings but we were already in the habit of meeting with our clients monthly to go through their financials and it was um we really were able to kind of just continue the momentum with our client experience but it’s just it’s so good it’s I’m so thankful that we had it in place because I’m not sure what would have happened yeah if we didn’t have it in place

Tom: Plus, there had to be an interesting, you know those regroup when you’re meeting at a higher level also, I’m sure those were really rich and powerful to understand what they were trying to accomplish

Chris: Yeah yeah, and it would change very quickly as well as as you guys remember during those times, so yeah yeah, we were fortunate that we had it in place

Kathy: We’ve got a couple of great questions that I want to make sure we get to, um, so as a marketer, I love this one. How has understanding your client’s experience impacted the way you go to market? Is this something you’re using as potentially a point of differentiation

Chris: I do think in our sales team there’s no question uh talks about it from day one, and we talk about not only um uh you know our client experience program but we talk about shared and mutual expectations, and we lay that foundation from the beginning, and I think that’s really helped us have a different kind of conversation during the sales process, and you would think that would be off-putting, but it actually really deepens our conversation during the sales process as well because they realize that one of our goals is to become a trusted advisor to really craft a solution for them that meets their needs and then we’re gonna we’re just not gonna be doing the debits and credits we’re going to take a personal interest in your business and your success that’s something we talk about regularly

Kathy: Did you

Tom: Hello

Kathy: When you’re recruiting for employees, is that conversation comes up at all in recruiting

Chris: Um, I think it’s changed a little bit, uh, the questions we ask and the type of people that we bring on although we’ve always really looked for you know not your typical accountant and be somebody who’s who we feel like is going to be able to deliver an exceptional client experience, and we that is a conversation we have now when we’re evaluating can’t recruit candidates and recruit how do you think they’re the accounting is there but how do you think they’re going to be on client experience right that’s like a question you asked from the very but from the very beginning with this like okay well then there are no you know if they can’t because we can hire anybody to do accounting but to deliver an exceptional client experience it takes well something extra

Tom: Are you finding that you can train for exceptional uh customer experience

Chris: The skills are very trainable um it’s just a matter of uh what what what’s their head trash and what’s their experience and what’s their whole back how long it takes to really become sort of part of who they are um you know there we go so far as to give them a series of questions to ask when they’re at a financial summit um that sort of deepened the relationship and so we’ve given them a ton of tools and um and so it is something that is trainable and practicable um, and we’re super patient with our team around this because we know that they don’t get any of this training in college when they’re taking accounting classes and so it’s not sort of natural for them so yeah it definitely is trainable it’s just you’ve got to really be committed to it and be committed to the fact that it’s ingrained in parts sort of who you are as a person of maturity that you are delivering an exceptional client experience

Tom: Love it. There’s another great question here, and I think it’s it’s an interesting thing, and what we talk about and teach our clients is how do I qualify and disqualify earlier in the relationship. Did you find that your research actually allowed you to the question, says were you able to find common red flags in which you would proactively choose to get out of a relationship with a potential client instead of waiting for the client to walk away?

Chris: Absolutely that’s why i say we’re much more proactive about that now and we’re really it’s it’s actually changed our sales process a little bit because we ask ourselves the question you know are we going to be able to get to great accounting with this client are they the type of people that are going to be committed to it are they going to be able to are they going to be are they going to communicate with us in a way that’s going to make it a successful relationship so hopefully what we’re doing is we’re screening out some of that and it’s hard i mean it’s like as they say your values are only your values when it costs you money it’s going to cost us money like we’re walking away from relationships before we even enter into the relationship if we know that we’re not going to be successful in the relationship because we can’t deliver an exceptional client experience because it’s something about this client’s approach to their business or their business maturity or something along those lines it’s it’s a hard decision to make but it keeps us from having to make that decision somewhere down the line and then we become more structured about how we decide to exit a relationship as well we’re not just walking away we are being much more deliberate about what are the what are those red flags and now we’ve set expectations up front, let’s go back to that expectation document and see whether the client can say, oh yeah, you’re right, I’m willing to kind of change or not, and if they’re not, we’re not the right solution, so it’s given us a lens through which to evaluate our client relationships much more effectively

Tom: Great stuff, really great stuff

Kathy: I love I you know we were talking about that as well you know is there an opportunity in that 90-day period I think you really do see how you’re going to work together so I think that’s your opportunity to reset expectations if it’s necessary um that you missed something in the sales process so I can’t believe how quickly all this hour has gone I could talk about this topic for three more hours at least um but we do want to let everybody know how to connect with Chris if they’ve got sexy accounting questions or if they’ve got um no any uh questions about you know some of the things that they did and want a little bit of a deeper dive he’s so lovely he’s always willing to share with other business leaders things that he’s learned and you know to share his experiences so there’s a couple of ways to reach out to him via LinkedIn or email and just put the business as unusual in the subject line so he knows that your question’s coming from today’s event and I would love to you know always show so much appreciation for our sponsors um tom thanks so much for being at cowhouse you always bring such a great um you know value to the conversation I also want to you know to talk about inspirity and hr source our other partners that are sponsoring the webinar and have been joining me as co-hosts as well and then our next event um coming up in september september 15th is um really a fascinating topic with a friend of chris and ours rob dubay from uh um he is going he’s founded a new company but let me give you a little rundown about rav so rab uh started his entrepreneurial journey selling blowpaps um in high school and now he’s leading one of Forbes best small companies he started his first business you know um it sat right out of high school but in 1991 he founded image one and so if you are familiar with the entrepreneurial operating system rob was one of the companies featured in Gina Whitman’s book traction and so he’s got a close relationship with Gino and he has developed a new organization um that is highlighting the 10 disciplines that eos leaders use to grow their companies and so this is going to be a really cool interactive session where Rob’s going to take us through these 10 disciplines and help us assess how we could bring back time bring back happiness to our personal lives and really add value and impact to our business um so I hope you know you don’t have to be an eos company to get some value out of this conversation and I hope you’ll join us on September uh 15th so again thank you to Chris and tom for joining me today it’s been fantastic and thank you to our audience for some great questions have a great rest of your day.